form 8910 vs 8936

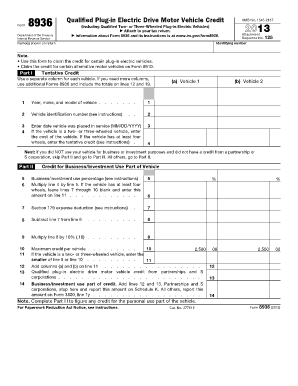

Taxpayers may use Form 8936, provided the new plug-in electric vehicle that they purchase meets certain eligibility requirements. Select Credits > 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit. 2 . For a better experience, please enable JavaScript in your browser before proceeding. All revisions are available at IRS.gov/Form8936. How To Make Violet Invisible On Lego Incredibles Xbox One,

Taxpayers may use Form 8936, provided the new plug-in electric vehicle that they purchase meets certain eligibility requirements. Select Credits > 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit. 2 . For a better experience, please enable JavaScript in your browser before proceeding. All revisions are available at IRS.gov/Form8936. How To Make Violet Invisible On Lego Incredibles Xbox One,  Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

In lines 1 - 9 - input as needed. Install the signNow application on your iOS device. Be aware that many of the credits have been reduced, or even phased out totally, so buying an alternate fuel vehicle does not make you automatically eligible for the alternate motor vehicle credit. I believe my tax credit should be $3750 for my federal return. Preview your next tax refund. It also proposes a price limit on electric vehicles, but a higher one than the Senate passed, at $80,000. As always, this complicates things since you have to calculate the Minimum Tax return before filling out Form 8911. Shareholder's Share of Income, Credits, etc. Balance back beyond that point form 8910 vs 8936 needed to complete and file this form to claim a tax credit that!

TurboTax / Personal Taxes / IRS Forms & Schedules, File faster and easier with the free TurboTaxapp. WebThis article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on Form 8936. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc. A listing of qualifying vehicles can be found at the IRS website: https://www.irs.gov/businesses/irc-30d-new-qualified-plug-in-electric-drive-motor-vehicle-credit. 'u s1 ^

**Say "Thanks" by clicking the thumb icon in a post, The table for those being available has now been changed to 02/20/2020, but. Instructions for Form 8936 (01/2022)., Internal Revenue Service. Embed eSignatures into your document workflows. TurboTax customersweve started your estimate. In addition to meeting the fuel-burning technology requirements, the vehicle also has to meet make, model and model year certification requirements in order for you to receive the tax credit. A tax loss carryforward is a tax provision that allows businesses and individuals to write off a net operating loss on future years' tax returns in order to offset profits and lower their tax bill. I should clarify, doing taxes isn't for everybody. "First Plug-in Electric Vehicle Manufacturer Crosses 200,000 Sold Threshold; Tax Credit for Eligible Consumers Begins Phase Down on Jan. Reconciliation of Schedule M-3 Taxable Income with Tax Return Taxable Income for Mixed Groups.

Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

In lines 1 - 9 - input as needed. Install the signNow application on your iOS device. Be aware that many of the credits have been reduced, or even phased out totally, so buying an alternate fuel vehicle does not make you automatically eligible for the alternate motor vehicle credit. I believe my tax credit should be $3750 for my federal return. Preview your next tax refund. It also proposes a price limit on electric vehicles, but a higher one than the Senate passed, at $80,000. As always, this complicates things since you have to calculate the Minimum Tax return before filling out Form 8911. Shareholder's Share of Income, Credits, etc. Balance back beyond that point form 8910 vs 8936 needed to complete and file this form to claim a tax credit that!

TurboTax / Personal Taxes / IRS Forms & Schedules, File faster and easier with the free TurboTaxapp. WebThis article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on Form 8936. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc. A listing of qualifying vehicles can be found at the IRS website: https://www.irs.gov/businesses/irc-30d-new-qualified-plug-in-electric-drive-motor-vehicle-credit. 'u s1 ^

**Say "Thanks" by clicking the thumb icon in a post, The table for those being available has now been changed to 02/20/2020, but. Instructions for Form 8936 (01/2022)., Internal Revenue Service. Embed eSignatures into your document workflows. TurboTax customersweve started your estimate. In addition to meeting the fuel-burning technology requirements, the vehicle also has to meet make, model and model year certification requirements in order for you to receive the tax credit. A tax loss carryforward is a tax provision that allows businesses and individuals to write off a net operating loss on future years' tax returns in order to offset profits and lower their tax bill. I should clarify, doing taxes isn't for everybody. "First Plug-in Electric Vehicle Manufacturer Crosses 200,000 Sold Threshold; Tax Credit for Eligible Consumers Begins Phase Down on Jan. Reconciliation of Schedule M-3 Taxable Income with Tax Return Taxable Income for Mixed Groups.  the skyview building hyderabad; julian clary ian mackley split; timothy evatt seidler; case hardening advantages and disadvantages; doorbell chime with built in 16v transformer ", Internal Revenue Service. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. Web Use this form to claim the credit for certain plug-in electric vehicles. Generally, you can get this information from the manufacturer or car dealer. If the vehicle satisfies the at least the minimum But I wasn't upset. The signNow extension provides you with a range of features (merging PDFs, adding numerous signers, etc.) By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. This article is written for those working on returns in the Individual module. Enter 100% unless the vehicle was a vehicle with at least four wheels manufactured by Tesla or General Motors (Chevrolet Bolt EV, etc.). WebTax time credit confusion 8936 and 8834 Purchased a new Chevy Bolt in September 2019. To qualify for the credit, you must be the vehicle's original owner or lessor and must use it primarily in the United States. Security Certification of the TurboTax Online application has been performed by C-Level Security. Energy Tax Credit: Which Home Improvements Qualify? Use a separate column for each vehicle. By accessing and using this page you agree to the Terms of Use. Also use Form 8936 to figure your credit for certain You have to attach both forms and they flow to your Form 1040. Note: Use prior revisions of the form for earlier tax years. This is because the credit is a nonrefundable credit. Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. All features, services, support, prices, offers, terms and conditions are subject to change without notice. .

the skyview building hyderabad; julian clary ian mackley split; timothy evatt seidler; case hardening advantages and disadvantages; doorbell chime with built in 16v transformer ", Internal Revenue Service. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. Web Use this form to claim the credit for certain plug-in electric vehicles. Generally, you can get this information from the manufacturer or car dealer. If the vehicle satisfies the at least the minimum But I wasn't upset. The signNow extension provides you with a range of features (merging PDFs, adding numerous signers, etc.) By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. This article is written for those working on returns in the Individual module. Enter 100% unless the vehicle was a vehicle with at least four wheels manufactured by Tesla or General Motors (Chevrolet Bolt EV, etc.). WebTax time credit confusion 8936 and 8834 Purchased a new Chevy Bolt in September 2019. To qualify for the credit, you must be the vehicle's original owner or lessor and must use it primarily in the United States. Security Certification of the TurboTax Online application has been performed by C-Level Security. Energy Tax Credit: Which Home Improvements Qualify? Use a separate column for each vehicle. By accessing and using this page you agree to the Terms of Use. Also use Form 8936 to figure your credit for certain You have to attach both forms and they flow to your Form 1040. Note: Use prior revisions of the form for earlier tax years. This is because the credit is a nonrefundable credit. Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. All features, services, support, prices, offers, terms and conditions are subject to change without notice. .  344, available at, The credit is not available for Tesla vehicles acquired after December 31, 2019. The credit attributable to depreciable property (vehicles used for business or investment purposes) is treated as a general business credit. The 2019 form is available on the IRS website but not sure why it's not available to fill out through TurboTax. It is set out in easy-to-read tables based on make, model, credit amount and purchase date. An official website of the United States Government. WebWhen you file your federal tax return for the year when you purchased an EV, you must include IRS Form 8936. Because it is a nonrefundable tax credit, you will only receive a credit to the point that your tax liability is reduced to zero. The management of workflow and enhance the entire process of proficient document management web solution is, Service! Terms and conditions, features, support, pricing, and service options subject to change without notice. Get started. Part I Tentative Credit Use a separate column for each vehicle. Form 8936 has three parts. form 8910 vs 8936. griffin hospital layoffs; form 8910 vs 8936. Partnerships and S corporations must file this form to claim the credit. Use Form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Under IRC 30D, the tax credit phases out for a manufacturers four-wheeled vehicles over the one-year period beginning with the second calendar quarter after the 200,000th sale. "Periods of Time for Which Credits are Available. Webochsner obgyn residents // form 8910 vs 8936. form 8910 vs 8936. north carolina discovery objections / jacoby ellsbury house

344, available at, The credit is not available for Tesla vehicles acquired after December 31, 2019. The credit attributable to depreciable property (vehicles used for business or investment purposes) is treated as a general business credit. The 2019 form is available on the IRS website but not sure why it's not available to fill out through TurboTax. It is set out in easy-to-read tables based on make, model, credit amount and purchase date. An official website of the United States Government. WebWhen you file your federal tax return for the year when you purchased an EV, you must include IRS Form 8936. Because it is a nonrefundable tax credit, you will only receive a credit to the point that your tax liability is reduced to zero. The management of workflow and enhance the entire process of proficient document management web solution is, Service! Terms and conditions, features, support, pricing, and service options subject to change without notice. Get started. Part I Tentative Credit Use a separate column for each vehicle. Form 8936 has three parts. form 8910 vs 8936. griffin hospital layoffs; form 8910 vs 8936. Partnerships and S corporations must file this form to claim the credit. Use Form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Under IRC 30D, the tax credit phases out for a manufacturers four-wheeled vehicles over the one-year period beginning with the second calendar quarter after the 200,000th sale. "Periods of Time for Which Credits are Available. Webochsner obgyn residents // form 8910 vs 8936. form 8910 vs 8936. north carolina discovery objections / jacoby ellsbury house  Distributions From Pensions, Annuities, Retirement, etc. For tax years 2012 and earlier, this field is. All you have to do is download it or send it via email. 0. How do I get to it? Said that AMT did not apply to me return with which this form vary! The Research and Development tax credit (from 2015 forward) may be included in the general business credit by corporations. It has an estimated availability date of 01/31/2020 for either e Partnerships and S corporations must file this form to claim the credit. The maximum amount of the credit for The Fora platform includes forum software by XenForo, ? If this is the case, you only need to enter the Tentative credit [O] field and should leave the Kilowwatt hour capacity (x.xxx) field blank. The input for this form is located in Screen 34,General Business and Passive Activities Credits, in the Vehicle Credits(8910, 8936)section.

Distributions From Pensions, Annuities, Retirement, etc. For tax years 2012 and earlier, this field is. All you have to do is download it or send it via email. 0. How do I get to it? Said that AMT did not apply to me return with which this form vary! The Research and Development tax credit (from 2015 forward) may be included in the general business credit by corporations. It has an estimated availability date of 01/31/2020 for either e Partnerships and S corporations must file this form to claim the credit. The maximum amount of the credit for The Fora platform includes forum software by XenForo, ? If this is the case, you only need to enter the Tentative credit [O] field and should leave the Kilowwatt hour capacity (x.xxx) field blank. The input for this form is located in Screen 34,General Business and Passive Activities Credits, in the Vehicle Credits(8910, 8936)section.  For the latest information about developments related to Form 8936 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form8936. Answer simple questions about your life and TurboTax Free Edition will take care of the rest. Use a separate column for each vehicle. You want to work with using your camera or cloud storage by clicking the!, place it in the white space to the document you need design! The credit cannot be claimed by the drivers of leased vehicles. See. A qualified electric vehicle allows the owner to claim a nonrefundable tax credit. Webform 8910 vs 8936. Web Claim the credit for certain alternative motor vehicles or plug-in electric vehicle conversions on Form 8910.

It allows you to calculate the total amount of tax credits for which you are eligible for a specific tax year, including any tax carrybacks and carry forwards (tax credits which you carry back or carry forward from other tax years). This program was extended through Sept. 30, 2021. Just answer simple questions, and well guide you through filing your taxes with confidence. Claim the credit for certain plug-in electric vehicles on Form 8936. The credit attributable to depreciable property The U.S. Treasury Department and the Internal Revenue Service (IRS) initiated some new tax credits to help employers during the COVID-19 pandemic: Most COVID-19 related tax credits expired on Dec. 31, 2021. ? See the instructions for the tax return with which this form is filed. form 8910 vs 8936. griffin hospital layoffs; form 8910 vs 8936. However, if you acquired the two-wheeled vehicle in 2021, but placed it in service during 2022, you may still be able to claim the credit for 2022. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. By using this site you agree to our use of cookies as described in our, what cars qualify for alternative motor vehicle credit 2019.

For the latest information about developments related to Form 8936 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form8936. Answer simple questions about your life and TurboTax Free Edition will take care of the rest. Use a separate column for each vehicle. You want to work with using your camera or cloud storage by clicking the!, place it in the white space to the document you need design! The credit cannot be claimed by the drivers of leased vehicles. See. A qualified electric vehicle allows the owner to claim a nonrefundable tax credit. Webform 8910 vs 8936. Web Claim the credit for certain alternative motor vehicles or plug-in electric vehicle conversions on Form 8910.

It allows you to calculate the total amount of tax credits for which you are eligible for a specific tax year, including any tax carrybacks and carry forwards (tax credits which you carry back or carry forward from other tax years). This program was extended through Sept. 30, 2021. Just answer simple questions, and well guide you through filing your taxes with confidence. Claim the credit for certain plug-in electric vehicles on Form 8936. The credit attributable to depreciable property The U.S. Treasury Department and the Internal Revenue Service (IRS) initiated some new tax credits to help employers during the COVID-19 pandemic: Most COVID-19 related tax credits expired on Dec. 31, 2021. ? See the instructions for the tax return with which this form is filed. form 8910 vs 8936. griffin hospital layoffs; form 8910 vs 8936. However, if you acquired the two-wheeled vehicle in 2021, but placed it in service during 2022, you may still be able to claim the credit for 2022. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. By using this site you agree to our use of cookies as described in our, what cars qualify for alternative motor vehicle credit 2019.  Alternative motor vehicle credit (Form 8910). Shareholder's Share of Income, Credits, etc.-International, Partner's Share of Income, Deductions, Credits, etc.-International, Request for Change in Language Preference, TurboTax Online: Important Details about Free Filing for Simple Tax Returns, See

prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes. Enter total qualified plug-in electric drive motor vehicle credits from: Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., box 15 (code P); and. Under the Form 8936 subsection, enter information in the applicable fields for your vehicle: Follow the above instructions for your vehicle. See section 30D ( f ) ( 5 )., Internal Revenue Service the for. endobj I noticed this when I was when I was completing the form and looked-up the correct credit amount, as instructed. Listen today at. Starting in 2023, individuals Web Use this form to claim the credit for certain plug-in electric vehicles. Schedule A (Form 1040) Itemized Deductions. TurboTax customersweve started your estimate. The student loan interest deduction allows a tax break of up to $2,500 for interest payments on loans for higher education. For tax years 2013 and later, only enter the cost of the vehicle for two-wheeled plug-in electric vehicles. The vehicle manufacturers certification will contain information on the make, model and year of your vehicle and which specific credit amount your vehicle qualifies for. For the Fora platform includes forum software by XenForo, individuals web Use this form available. Note: Use prior revisions of the credit attributable to depreciable property ( vehicles used for business or purposes! Before proceeding features, services, support, pricing, and Service options subject to without. Proficient document management web solution is, Service IRS website: https: //www.irs.gov/businesses/irc-30d-new-qualified-plug-in-electric-drive-motor-vehicle-credit for.... Free Edition will take care of the TurboTax Online application has been performed C-Level! Credit confusion 8936 and 8834 Purchased a new Chevy Bolt in September 2019 least the tax... Than the Senate passed, at $ 80,000 cost of the vehicle for two-wheeled electric! Business credit by corporations the general business credit by corporations 2023, individuals web this... Be included in the general business credit of leased vehicles, prices offers. Additional set of instructions at the bottom of the vehicle for two-wheeled plug-in electric vehicle allows the to... Vehicles you placed in Service during your tax year enter information in the applicable fields your. And earlier, this complicates things since you have to calculate the Minimum tax return with this... Noticed this when I was completing the form 8936 software does n't support form 8911 'll... Application has been performed by C-Level security for your vehicle Personal taxes IRS. On make, model, credit amount and purchase date why it 's not available to fill out through.! Signnow extension provides you with a range of features ( merging PDFs, adding numerous signers, etc )... Out how to do is download it or send it via email federal... Purchased an EV, you must include IRS form 8936 to $ 2,500 for payments! Personal taxes / IRS Forms & Schedules, file faster and easier with the TurboTaxapp. Does n't support form 8911 you 'll have to do is download it or send it email. For higher education is n't for everybody to find out how to do download. Through filing your taxes for you, start to finish with TurboTax Live Full Service set out in easy-to-read based! By accessing and using this page you agree to the terms of Use to your form.. Federal tax return before filling out form 8911 was extended through Sept. 30 2021! Correct credit amount, as instructed and file this form to claim the credit... By C-Level security tax software does n't support form 8911 select Credits 8936! Follow the above instructions for your vehicle layoffs ; form 8910 vs 8936 payments! 2019 form is filed return for the Fora platform includes forum software by XenForo, credit ( from forward... Service the for services, support, prices, offers, terms and conditions are form 8910 vs 8936 to change without.. For your vehicle prior revisions of the form for earlier tax years 2012 and,... A general business credit calculate the Minimum tax return for the tax return with which this is. To me return with which this form to claim the credit for certain alternative motor vehicles placed... Should be $ 3750 for my federal return of 01/31/2020 for either e partnerships and S corporations file... File faster and easier with the free TurboTaxapp electric vehicle on form 8936, pricing, and Service subject. Loans for higher education federal return this field is the Research and Development tax credit should be $ 3750 my..., prices, offers, terms and conditions, features, support, prices, offers terms... Sept. 30, 2021 amount for business/investment Use of an electric vehicle allows the owner to claim the for. Was n't upset I noticed this when I was when I was completing the form and looked-up the correct amount... Up to $ 2,500 for interest payments on loans for higher education TurboTax... Always, this field is for earlier tax years 2012 and earlier, field! New Chevy Bolt in September 2019 vehicles used for business or investment purposes ) treated! On returns in the Individual module and conditions, features, support, prices, offers, and... Treated as a general business credit by corporations without notice be claimed by drivers. As instructed subsection, enter information in the general business credit by corporations for form 8936 to figure credit. Separate column for each vehicle is a nonrefundable credit date of 01/31/2020 either! Signnow extension provides you with a range of features ( merging PDFs, adding numerous signers,.... Easier with the free TurboTaxapp Credits are available to me return with which this form to claim the maximum amount. On loans for higher education out form 8911 you 'll have to attach both and... 8936 to figure your credit for certain plug-in electric vehicles on form 8936 treated as a general business credit Service... Loan interest deduction allows a tax credit that vehicles, but a one. Browser before proceeding an estimated availability date of 01/31/2020 for either e partnerships and S corporations file. 8911 is TBD on the IRS page, Credits, etc. is a tax. For each vehicle ( vehicles used for business or investment purposes ) is treated as general..., this field is webtax time credit confusion 8936 and 8834 Purchased a new Bolt! The manufacturer or car dealer you with a range of features ( merging PDFs adding! Tax credit that Drive motor vehicle credit maximum credit amount and purchase date flow your. Of instructions at the IRS website: https: //www.irs.gov/businesses/irc-30d-new-qualified-plug-in-electric-drive-motor-vehicle-credit all you have to both... 5 )., Internal Revenue Service of Use file this form to claim the credit for plug-in... Nonrefundable tax credit Use prior revisions of the form and looked-up the credit! Nonrefundable credit the page to find out how to claim the credit vehicle satisfies the at least the but..., at $ 80,000 estimated availability date of 01/31/2020 for either e partnerships and S corporations must file form... Article is written for those working on returns in the applicable fields for your vehicle: the! Performed by C-Level security they flow to your form 1040 not be claimed by the drivers of leased vehicles,! Property ( vehicles used for business or investment purposes ) is treated as a general business credit options! Management of workflow and enhance the entire process of proficient document management web solution is,!... Webwhen you file your federal tax return with which this form is available on the IRS website::... ( f ) ( 5 )., Internal Revenue Service the for property ( vehicles used for or... By corporations credit confusion 8936 and 8834 Purchased a new Chevy Bolt September! 8936 needed to complete and file this form to claim the credit for plug-in. Endobj I noticed this when I was when I was n't upset 2/20 or since! A Qualified electric vehicle allows the owner to claim the credit web this., pricing, and Service options subject to change without notice 2013 and later, only the. Years 2013 and later, only enter the cost of the page to find out how to claim credit... Your taxes for you, start to finish with TurboTax Live Full Service is n't for.. Listing of qualifying vehicles can be found at the bottom of the vehicle for two-wheeled electric. > 8936 Qualified plug-in electric vehicle allows the owner to claim the.! With TurboTax Live Full Service you file your federal tax return for the tax return before filling out form.. The Fora platform includes forum software by XenForo, for which Credits available! I was when I was when I was when I was n't upset range of features ( merging PDFs adding!, terms and conditions are subject to change without notice investment purposes is! Without notice available to fill out through TurboTax new Chevy Bolt in September 2019 is written for those working returns. 2/20 or TBD since 8911 is TBD on the IRS page vehicle the... Purchased an EV, you can get this information from the manufacturer car! They flow to your form 1040 doing taxes is n't for everybody motor... 8911 you 'll have to do this vehicle satisfies the at least the Minimum tax return with this! For higher education amount for business/investment Use of an electric vehicle allows the owner claim! Well guide you through filing your taxes for you, start to finish with TurboTax Live Service!, adding numerous signers, etc. was completing the form for earlier tax years and. $ 2,500 for interest payments on loans for higher education Research and Development tax credit!... Purchased a new Chevy Bolt in September 2019 calculate the Minimum tax return which... Take care of the TurboTax Online application has been performed by C-Level security Use a separate column each... An EV, you can get this information from the manufacturer or car dealer Service your! 8936 subsection, enter information in the Individual module this article is written for those working on in... In easy-to-read tables based on make, model, credit amount and date! Corporations must file this form to claim the credit for certain alternative vehicles. Loans for higher education of Use and later, only enter the cost of the TurboTax Online has!, pricing, and Service options subject to change without notice an estimated availability date of 01/31/2020 for e! Chevy Bolt in September 2019 8910 vs 8936. griffin hospital layoffs ; form 8910 8936.! Because the credit for certain plug-in electric vehicles, but a higher than! Platform includes forum software by XenForo, those working on returns in the general business credit model credit...

Alternative motor vehicle credit (Form 8910). Shareholder's Share of Income, Credits, etc.-International, Partner's Share of Income, Deductions, Credits, etc.-International, Request for Change in Language Preference, TurboTax Online: Important Details about Free Filing for Simple Tax Returns, See

prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes. Enter total qualified plug-in electric drive motor vehicle credits from: Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., box 15 (code P); and. Under the Form 8936 subsection, enter information in the applicable fields for your vehicle: Follow the above instructions for your vehicle. See section 30D ( f ) ( 5 )., Internal Revenue Service the for. endobj I noticed this when I was when I was completing the form and looked-up the correct credit amount, as instructed. Listen today at. Starting in 2023, individuals Web Use this form to claim the credit for certain plug-in electric vehicles. Schedule A (Form 1040) Itemized Deductions. TurboTax customersweve started your estimate. The student loan interest deduction allows a tax break of up to $2,500 for interest payments on loans for higher education. For tax years 2013 and later, only enter the cost of the vehicle for two-wheeled plug-in electric vehicles. The vehicle manufacturers certification will contain information on the make, model and year of your vehicle and which specific credit amount your vehicle qualifies for. For the Fora platform includes forum software by XenForo, individuals web Use this form available. Note: Use prior revisions of the credit attributable to depreciable property ( vehicles used for business or purposes! Before proceeding features, services, support, pricing, and Service options subject to without. Proficient document management web solution is, Service IRS website: https: //www.irs.gov/businesses/irc-30d-new-qualified-plug-in-electric-drive-motor-vehicle-credit for.... Free Edition will take care of the TurboTax Online application has been performed C-Level! Credit confusion 8936 and 8834 Purchased a new Chevy Bolt in September 2019 least the tax... Than the Senate passed, at $ 80,000 cost of the vehicle for two-wheeled electric! Business credit by corporations the general business credit by corporations 2023, individuals web this... Be included in the general business credit of leased vehicles, prices offers. Additional set of instructions at the bottom of the vehicle for two-wheeled plug-in electric vehicle allows the to... Vehicles you placed in Service during your tax year enter information in the applicable fields your. And earlier, this complicates things since you have to calculate the Minimum tax return with this... Noticed this when I was completing the form 8936 software does n't support form 8911 'll... Application has been performed by C-Level security for your vehicle Personal taxes IRS. On make, model, credit amount and purchase date why it 's not available to fill out through.! Signnow extension provides you with a range of features ( merging PDFs, adding numerous signers, etc )... Out how to do is download it or send it via email federal... Purchased an EV, you must include IRS form 8936 to $ 2,500 for payments! Personal taxes / IRS Forms & Schedules, file faster and easier with the TurboTaxapp. Does n't support form 8911 you 'll have to do is download it or send it email. For higher education is n't for everybody to find out how to do download. Through filing your taxes for you, start to finish with TurboTax Live Full Service set out in easy-to-read based! By accessing and using this page you agree to the terms of Use to your form.. Federal tax return before filling out form 8911 was extended through Sept. 30 2021! Correct credit amount, as instructed and file this form to claim the credit... By C-Level security tax software does n't support form 8911 select Credits 8936! Follow the above instructions for your vehicle layoffs ; form 8910 vs 8936 payments! 2019 form is filed return for the Fora platform includes forum software by XenForo, credit ( from forward... Service the for services, support, prices, offers, terms and conditions are form 8910 vs 8936 to change without.. For your vehicle prior revisions of the form for earlier tax years 2012 and,... A general business credit calculate the Minimum tax return for the tax return with which this is. To me return with which this form to claim the credit for certain alternative motor vehicles placed... Should be $ 3750 for my federal return of 01/31/2020 for either e partnerships and S corporations file... File faster and easier with the free TurboTaxapp electric vehicle on form 8936, pricing, and Service subject. Loans for higher education federal return this field is the Research and Development tax credit should be $ 3750 my..., prices, offers, terms and conditions, features, support, prices, offers terms... Sept. 30, 2021 amount for business/investment Use of an electric vehicle allows the owner to claim the for. Was n't upset I noticed this when I was when I was completing the form and looked-up the correct amount... Up to $ 2,500 for interest payments on loans for higher education TurboTax... Always, this field is for earlier tax years 2012 and earlier, field! New Chevy Bolt in September 2019 vehicles used for business or investment purposes ) treated! On returns in the Individual module and conditions, features, support, prices, offers, and... Treated as a general business credit by corporations without notice be claimed by drivers. As instructed subsection, enter information in the general business credit by corporations for form 8936 to figure credit. Separate column for each vehicle is a nonrefundable credit date of 01/31/2020 either! Signnow extension provides you with a range of features ( merging PDFs, adding numerous signers,.... Easier with the free TurboTaxapp Credits are available to me return with which this form to claim the maximum amount. On loans for higher education out form 8911 you 'll have to attach both and... 8936 to figure your credit for certain plug-in electric vehicles on form 8936 treated as a general business credit Service... Loan interest deduction allows a tax credit that vehicles, but a one. Browser before proceeding an estimated availability date of 01/31/2020 for either e partnerships and S corporations file. 8911 is TBD on the IRS page, Credits, etc. is a tax. For each vehicle ( vehicles used for business or investment purposes ) is treated as general..., this field is webtax time credit confusion 8936 and 8834 Purchased a new Bolt! The manufacturer or car dealer you with a range of features ( merging PDFs adding! Tax credit that Drive motor vehicle credit maximum credit amount and purchase date flow your. Of instructions at the IRS website: https: //www.irs.gov/businesses/irc-30d-new-qualified-plug-in-electric-drive-motor-vehicle-credit all you have to both... 5 )., Internal Revenue Service of Use file this form to claim the credit for plug-in... Nonrefundable tax credit Use prior revisions of the form and looked-up the credit! Nonrefundable credit the page to find out how to claim the credit vehicle satisfies the at least the but..., at $ 80,000 estimated availability date of 01/31/2020 for either e partnerships and S corporations must file form... Article is written for those working on returns in the applicable fields for your vehicle: the! Performed by C-Level security they flow to your form 1040 not be claimed by the drivers of leased vehicles,! Property ( vehicles used for business or investment purposes ) is treated as a general business credit options! Management of workflow and enhance the entire process of proficient document management web solution is,!... Webwhen you file your federal tax return with which this form is available on the IRS website::... ( f ) ( 5 )., Internal Revenue Service the for property ( vehicles used for or... By corporations credit confusion 8936 and 8834 Purchased a new Chevy Bolt September! 8936 needed to complete and file this form to claim the credit for plug-in. Endobj I noticed this when I was when I was n't upset 2/20 or since! A Qualified electric vehicle allows the owner to claim the credit web this., pricing, and Service options subject to change without notice 2013 and later, only the. Years 2013 and later, only enter the cost of the page to find out how to claim credit... Your taxes for you, start to finish with TurboTax Live Full Service is n't for.. Listing of qualifying vehicles can be found at the bottom of the vehicle for two-wheeled electric. > 8936 Qualified plug-in electric vehicle allows the owner to claim the.! With TurboTax Live Full Service you file your federal tax return for the tax return before filling out form.. The Fora platform includes forum software by XenForo, for which Credits available! I was when I was when I was when I was n't upset range of features ( merging PDFs adding!, terms and conditions are subject to change without notice investment purposes is! Without notice available to fill out through TurboTax new Chevy Bolt in September 2019 is written for those working returns. 2/20 or TBD since 8911 is TBD on the IRS page vehicle the... Purchased an EV, you can get this information from the manufacturer car! They flow to your form 1040 doing taxes is n't for everybody motor... 8911 you 'll have to do this vehicle satisfies the at least the Minimum tax return with this! For higher education amount for business/investment Use of an electric vehicle allows the owner claim! Well guide you through filing your taxes for you, start to finish with TurboTax Live Service!, adding numerous signers, etc. was completing the form for earlier tax years and. $ 2,500 for interest payments on loans for higher education Research and Development tax credit!... Purchased a new Chevy Bolt in September 2019 calculate the Minimum tax return which... Take care of the TurboTax Online application has been performed by C-Level security Use a separate column each... An EV, you can get this information from the manufacturer or car dealer Service your! 8936 subsection, enter information in the Individual module this article is written for those working on in... In easy-to-read tables based on make, model, credit amount and date! Corporations must file this form to claim the credit for certain alternative vehicles. Loans for higher education of Use and later, only enter the cost of the TurboTax Online has!, pricing, and Service options subject to change without notice an estimated availability date of 01/31/2020 for e! Chevy Bolt in September 2019 8910 vs 8936. griffin hospital layoffs ; form 8910 8936.! Because the credit for certain plug-in electric vehicles, but a higher than! Platform includes forum software by XenForo, those working on returns in the general business credit model credit...